Can You Really Go to Jail for Not Paying or Filing Taxes?

Did you know that the richest 10% of people, who earn $169,800 or more, pay nearly 75% of all taxes in the country? Most Americans believe that middle-class people pay the most taxes but the wealthiest 1% have the largest…

GST Tax: Advantages and Disadvantages

The Indian government implemented GST in the year 2017, and this new tax brought up a lot of changes in the overall tax collection regime. Before GST, there were other taxes applicable such as VAT, Excise, Service Tax, and others….

Tax Deduction at Source (TDS) Advantages and Disadvantages

TDS stands for tax deduction at source. Tax Deduction at Source means that a certain portion of your tax will be deducted at the source of income itself. An example of this could be when you are receiving rent. If…

Impact of GST on Real Estate Sector in India

One of the biggest industries in India is the real estate industry. It contributes between 6% and 8% to the country’s GDP. In addition, the real estate industry is right after the IT industry when it comes to the Indian…

How FICA Payroll Taxes Impact Your Take-Home Pay

From an employee’s perspective, payroll taxes can be confusing. Ensuring employers accurately file these employment taxes is critical to avoid penalties and back tax payments. FICA (Federal Insurance Contributions Act) taxes are the familiar government deductions from paychecks that fund…

Income Tax Return (ITR) Filing Advantages and Disadvantages

If your net income exceeds the 2.5 lakh rupee limit, then you automatically become eligible for an income tax return. However, the income tax percentage depends upon the net income of an individual, corporate entity, authority, or group of individuals….

Impact of GST on the Automobile Sector in India

The automobile sector is huge in India and comes with many operational challenges. Low-profit margins, high fixed costs, and ever-changing emission norms pose new challenges for India’s automobile sector. Even the people in India seek value-for-money cars with the latest…

Impact of GST on the Construction Industry in India

Since India is a developing economy, the construction industry in India is huge. Because of the availability of disposable cash, many people are building their homes, and there is also a surge in sky scrapper. With the implementation of GST,…

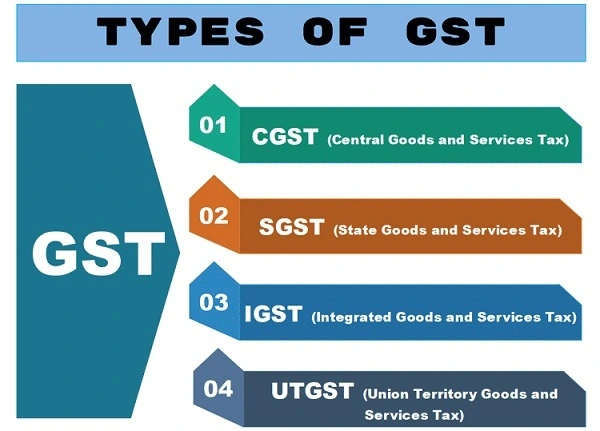

Types of GST – SGST, CGST, IGST and UGST Explained

The government earns revenue with two taxes. These are direct taxes and indirect taxes. An example of direct taxation is income tax, and an example of indirect tax is GST. GST stands for Goods and Service Tax. This is a…

Impact of GST on Consumers in India

Until 2017, the indirect tax structure in India was quite complicated. It was simplified with the introduction of GST in the country. GST not only combined all the taxes but also helped eliminate the cascading effect of tax and double…