The government earns revenue with two taxes. These are direct taxes and indirect taxes. An example of direct taxation is income tax, and an example of indirect tax is GST. GST stands for Goods and Service Tax. This is a value-added tax that replaced all the other taxes in the country. The supply of goods and services for domestic consumption attracts GST. This was a very visionary taxation system that the government adopted. Before the implementation of GST, there were dozens of taxes, leading to a fair amount of confusion and compliance issues. After the implementation of GST, all those taxes were removed and replaced by the GST.

Types of GST in India

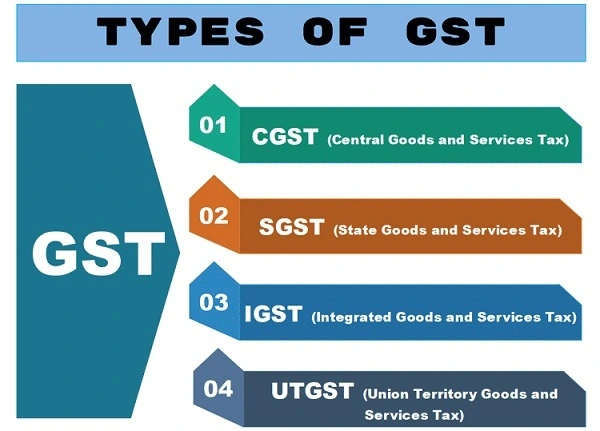

Primarily you would have known CGST (Central Goods and Service Tax) and SGST (State Goods and Service Tax). However, there are two additional components under the GST framework. These are IGST (Integrated Goods and Service Tax) and UTGST (Union Territory Goods and Services Tax). UTGST is also known as UGST. These components of GST are added to goods and services depending on the demand and consumption of the goods. What is important here is to use the correct GSTIN for the proper identification of the applicable tax.

There is a fair amount of confusion between the four types of GST, and today, we will help you clear this confusion. We have shared more information on this page about SGST, CGST, IGST and UGST. Let us check them out in detail.

What is IGST?

As mentioned earlier, IGST stands for Integrated Goods and Service Tax. This tax is levied on products and services during the interstate supplies. The tax is also applicable when the transaction of goods and services happens between two or more states and union territories. The scope of IGST is well defined under the IGST Act of 2017. To ensure that the act is in the best interest of the public, it is amended from time to time. It is important to note that the IGST applies when the goods are exported or imported to India.

Since the GST is a consumption-based tax, no tax applies to exports. However, the tax is applicable during the import and IGST is shared between the central and the state government.

Example of IGST

Let us take an example to understand IGST better. For example, there is a business registered in Delhi, and it sells goods to a business or an individual in Gujarat. The value of goods is estimated to be Rs 1 Lakh, and the tax rate applicable on the products is 15%. The IGST applicable here is 15,000, and the entity in Gujarat would have to pay this. This tax will be deposited to the centre, and in a later stage, the tax will be divided between the centre and the state government of Gujarat. The tax will not be given to Delhi since Gujarat is where products or services are consumed.

What is CGST?

One of the most crucial components of GST is the CGST. It stands for Central Goods and Service Tax. This component of GST is levied on the intrastate supply of goods and services. The central government levies the tax, and the coffers collect it. All the rules and regulations around CGST are defined under the CGST Act of 2017. This Act is also amended from time to time to ensure that it is in sync with the modern era and suits the public’s interest.

Another important point is that the same amount of SGST is charged on such transactions, and the state government retains this tax component. So, if the seller is selling a product within the same state, then CGST and SGST will apply. This also reflects that the state and the central government have agreed on the revenue-sharing model for the tax. The tax rate for CGST should not exceed over 14%, and this is defined in section 8 of the CGST Act. It should be noted that any tax liability under CGST can only be offset against IGST or CGST. It is not possible to offset the liability under CGST with the SGST.

What is SGST?

As you might know, SGST stands for State Goods and Service Tax. SGST is levied on the intrastate supply of services and goods. It is applicable in the state where the product is sold and consumed. Remember that SGST is a consumption-based tax and not a production-based tax. The state government collects the SGST, and the regulations around SGST are defined under the SGST Act of 2017. This act is also amended from time to time so that it benefits all. All the state taxes, like the entertainment tax, VAT, luxury tax and entry tax, were merged into SGST. In the section related to CGST, we have mentioned that CGST is also levied on products for intrastate consumption. This means that any such product will attract SGST and CGST. It is important to note that the liability under SGST can be offset against SGST or IGST. You can’t offset the SGST liability with CGST.

Examples of CGST and SGST

We are combining the example of SGST and CGST so it will be easy for you to understand. Let us understand CGST with an example. Here, a manufacturer from Rajasthan produced certain goods. These goods were sold within the state. The value of these products was Rs 1 Lakh, and the tax applicable on the goods was 18%. In such a case, the tax that the buyer will pay is Rs 18,000. Half of the tax will go to the central government, and half will go to the state government. The component going to the central government is the CGST, and the component to the state government is SGST.

What is UGST?

UGST is similar to SGST, but the only difference is that UGST is applicable when the transaction happens in union territories. The tax regulations are under the UTGST Act of 2017. There is no difference between the SGST and UTGST. The split is similar to the CGST and SGST. UTGST applies to consumptions in Ladakh, Jammu & Kashmir, Andaman & Nicobar, Chandigarh, Daman & Diu, Dadra & Nagar Haveli and Lakshadweep. Please note that the UGST does not apply to Delhi and Puducherry. These two areas fall under the scope of SGST since these states have their legislature. Talking about the input tax credit for UTGST, it is possible to offset the liability with UTGST and IGST but not with CGST.

Why is There a Split in GST?

The split under GST is very important because of India’s governance structure. Since India is a federal country, the state and the central government have certain powers given to them by the Constitution. With this power also comes responsibilities, and to meet these obligations, these governments need money. This money is collected in indirect taxes, and this is where GST comes into the picture. The split of GST helps the government in dividing the tax collected. The split ensures an easy split, but at the same time, it ensures that the One Nation One Tax system is implemented for the public.

How To Determine Which Tax is Applicable?

One question we get very frequently is about the factors determining which tax will be applicable. The answer to this question is very simple. The type of tax levied on the products or services depends on the supply and consumption of the same. For example, if the production and consumption are in the same state, the transaction is considered intrastate. The CGST and SGST are applicable in such a case, and an equal split is deposited to the central and state governments.

Things are slightly different when the producer and the consumer are in different states. The transaction is called the interstate transaction, and the IGST is collected from the buyer. The split of IGST has already been explained in one of the sections above. So, in short, the product’s production and consumption will define the component of GST that is applicable to them.

Input Tax Credit Under GST

One of the advantages of GST is that the input tax credit is available for businesses. In such a case, it becomes very important to utilize the ITC properly, or else you may get a notice from the government. Let us understand this with an example.

For trade, a manufacturer named ABC sold goods to XYZ in Telangana. The value of these goods is Rs 10,000. Now XYZ sells these products to a buyer ‘F’ in Tamil Nadu for Rs 17,500. In the final step, let us assume that the buyer ‘F’ in Tamil Nadu sold the goods to the end-user for Rs 30,000. The tax rate applicable here is RS 18%.

Here the transaction between ABC to XYZ would attract a tax of Rs 1800. Similarly, the transaction between XYZ and F will attract a tax of Rs 3150. However, XYZ can offset the input tax credit of Rs 1800 he paid during the first transaction, and the tax liability will reduce to Rs 1350.

Similarly, the input tax credit will be adjusted when the product is sold to the end consumer.

Final Take

This was all about the four components of GST. We are sure that you will be able to understand these components of GST in a better way now. In addition, if you run a business, you must ensure 100% compliance with the GST or else you may risk getting penalized by the tax department. As a customer, you must know your right and what taxes apply to your transactions. Moreover, you must also know the tax rates applicable to the various categories so that no one can charge you extra when you avail of products or services. Please get in touch with us via the comment section if you still have any questions about SGST, CGST, IGST or UGST.