Under the Radar: Tracing Bitcoin’s Less Obvious Influence on Cryptocurrencies

Since its inception in 2009, Bitcoin has stood as the pioneer of cryptocurrencies, leaving an indelible mark on the digital financial landscape. While it continues to lead the way, it’s vital to acknowledge its far-reaching impact, which extends beyond market dominance and price fluctuations. This article delves into the often-overlooked ways in which Bitcoin influences the wider cryptocurrency realm, from market sentiment to technological innovation.

Bitcoin’s Dominance and Market Sentiment

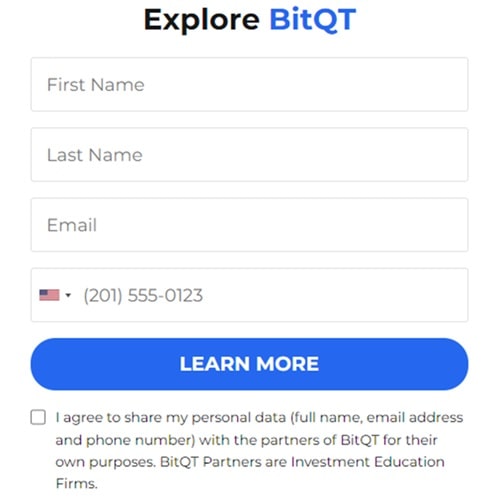

Bitcoin’s dominance, or its market capitalization as a percentage of the total cryptocurrency market, is a critical metric in the crypto space. When Bitcoin experiences significant price movements, it often leads to shifts in overall market sentiment. Investors and traders closely monitor Bitcoin’s performance as a leading indicator of the crypto market’s health. When Bitcoin rises, it can create a bullish sentiment across the entire crypto ecosystem, boosting the prices of other digital assets. Click the image below to learn about the art of investing and level up your experience.

Bitcoin as a Benchmark for New Projects

Bitcoin serves as a benchmark for new cryptocurrency projects. Developers and investors often compare their creations to Bitcoin, which has established itself as the gold standard of digital currency. This benchmarking practice can both inspire innovation and create unrealistic expectations. While aspiring to reach Bitcoin’s level of success is ambitious, it can sometimes stifle creativity as projects try to replicate Bitcoin’s features rather than explore new possibilities.

Also See: Charting New Territories: Bitcoin-Influenced Cryptocurrencies

Liquidity and Trading Pairs

An often-overlooked facet of Bitcoin’s influence on the cryptocurrency market lies in its pivotal role in providing liquidity. Liquidity, essentially the ease of trading an asset without causing substantial price shifts, is a fundamental factor in financial markets. Bitcoin’s exceptional liquidity status renders it a top choice as a trading pair for numerous altcoins. When investors seek to buy or sell smaller cryptocurrencies, they frequently do so via Bitcoin as an intermediary. This reliance on Bitcoin as a trading pair implies that any price fluctuations in Bitcoin can trigger a cascading impact throughout the broader cryptocurrency market, underscoring the profound interconnection within this digital financial ecosystem.

Network Security and Mining

Bitcoin’s mining infrastructure plays a crucial role in securing its network. The computational power dedicated to mining Bitcoin surpasses that of any other cryptocurrency. This dominance extends to the influence Bitcoin miners wield over the broader crypto ecosystem. The concentration of mining power in Bitcoin can make it vulnerable to attacks, potentially impacting the security of other cryptocurrencies that share similar consensus mechanisms.

Regulatory Influence and Legal Precedent

Bitcoin’s pioneering path through the labyrinth of regulatory challenges has established significant benchmarks for the entire cryptocurrency landscape. As the first widely embraced digital currency, Bitcoin has been subjected to intense regulatory scrutiny, resulting in the formulation of regulatory frameworks and legal precedents that reverberate across the entire crypto sphere. The legal battles and dialogues that have revolved around Bitcoin have essentially forged a roadmap for other blockchain projects, equipping them with invaluable insights into both the potential pitfalls and the promising opportunities that lie ahead in the complex world of cryptocurrency regulation.

Technological Innovations and Cross-Pollination

Bitcoin’s role extends beyond being a digital store of value; it’s a catalyst for technological progress in the cryptocurrency space. Notably, innovations like the Lightning Network, which enables faster and more cost-effective transactions, have implications that reach far beyond Bitcoin itself. These breakthroughs often serve as inspiration for other cryptocurrencies to enhance their own technologies. Moreover, the exchange of ideas and solutions between Bitcoin and alternative blockchain projects promotes a spirit of healthy competition and collaboration, propelling the entire industry forward technologically.

Conclusion

In conclusion, Bitcoin’s influence on the cryptocurrency market goes beyond its market dominance and price movements. It serves as a barometer for market sentiment, a benchmark for new projects, a source of liquidity, and a trailblazer in the regulatory and technological landscapes. Understanding these less obvious ways in which Bitcoin shapes the crypto ecosystem is crucial for investors, developers, and regulators alike. As the crypto market continues to evolve, keeping a keen eye on these hidden dynamics will be paramount for navigating the ever-changing landscape of digital assets.