Impact of GST on the Automobile Sector in India

The automobile sector is huge in India and comes with many operational challenges. Low-profit margins, high fixed costs, and ever-changing emission norms pose new challenges for India’s automobile sector. Even the people in India seek…

Impact of GST on the Construction Industry in India

Since India is a developing economy, the construction industry in India is huge. Because of the availability of disposable cash, many people are building their homes, and there is also a surge in sky scrapper. With the implementation of GST, everyone was…

12 Best Franchise Under 10 Lakhs Rs. In India

Without a doubt, an investment of 10 lakh rupees for a business in India is a pretty good one. With such a decent investment, you can definitely give a good start to your business initially, which will be incredibly beneficial in the long run. And when…

Democratizing Investments: Dai’s Venture Capital Tokenization

Tokenized venture capital and the emergence of Dai have revolutionized investment opportunities, paving the way for a more inclusive and democratized investment landscape. In this article, we will explore the rise of Dai in venture capital and…

Top 10 Best Ship Management Companies in the World

The shipping industry is the backbone of the global economy. Without the shipping industry, the price of logistics would increase by multiple folds. Shipping bulk goods by aeroplane is not viable, and hence the shipping industry offers economical,…

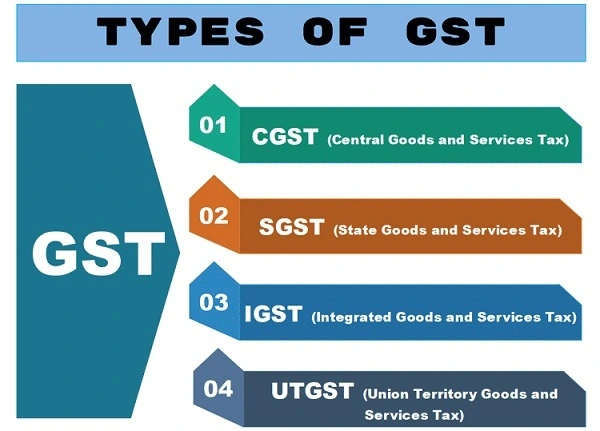

Types of GST – SGST, CGST, IGST and UGST Explained

The government earns revenue with two taxes. These are direct taxes and indirect taxes. An example of direct taxation is income tax, and an example of indirect tax is GST. GST stands for Goods and Service Tax. This is a value-added tax that replaced all…

Impact of GST on Consumers in India

Until 2017, the indirect tax structure in India was quite complicated. It was simplified with the introduction of GST in the country. GST not only combined all the taxes but also helped eliminate the cascading effect of tax and double taxation. The tax…