What Is The Use Of Abha Card: Benefits, Apply & Documents

The Ayushman Bharat Health Account (ABHA) card is a crucial component of India’s healthcare infrastructure, designed to facilitate seamless and efficient access to medical services. This card is part of the Ayushman Bharat Digital Mission (ABDM), which aims to create a robust digital health ecosystem in India. In this guide, we will explore the benefits of the ABHA card, how to apply for it, and the necessary documents required for the application. Additionally, we will touch on the significance of health insurance for senior citizens in ensuring comprehensive healthcare coverage.

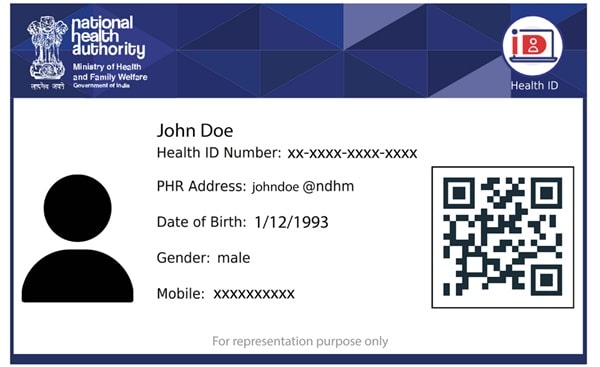

What is the ABHA Card?

The ABHA card is a unique health identification card issued to individuals under the Ayushman Bharat Digital Mission. It serves as a digital repository of a person’s health records, enabling easy access to medical history and facilitating better coordination among healthcare providers.

Key Features of the ABHA Card

- Unique Health ID: Each ABHA card comes with a unique health ID that links to an individual’s health records, ensuring secure and efficient access to medical information.

- Digital Health Records: The card stores digital health records, including past treatments, medical conditions, and prescriptions, which can be accessed by authorized healthcare providers.

- Interoperability: The ABHA card promotes interoperability among different healthcare systems, allowing seamless exchange of health information across various platforms.

Benefits of the ABHA Card

The ABHA card offers numerous benefits to both individuals and healthcare providers, enhancing the overall efficiency and quality of healthcare services.

For Individuals

- Streamlined Access to Healthcare: With the ABHA card, individuals can access their health records from any registered healthcare provider, ensuring timely and efficient medical care.

- Improved Healthcare Coordination: The card allows for better coordination among healthcare providers, reducing the risk of medical errors and ensuring continuity of care.

- Personal Health Record Management: Individuals can manage their personal health records, track their medical history, and make informed decisions about their healthcare.

For Healthcare Providers

- Efficient Patient Management: Healthcare providers can access accurate and up-to-date health information, facilitating better diagnosis and treatment plans.

- Reduced Administrative Burden: The digital nature of the ABHA card reduces paperwork and administrative tasks, allowing healthcare professionals to focus more on patient care.

- Enhanced Patient Outcomes: With comprehensive health information at their fingertips, providers can deliver personalized and effective treatments, improving patient outcomes.

How to Apply for an ABHA Card

Here are the steps to apply for an ABHA card:

- Visit the Official Portal: Go to the official Ayushman Bharat Digital Mission website.

- Create a Health ID: Click on the “Create Your ABHA” button and provide your mobile number or Aadhaar number to generate an OTP (One-Time Password).

- Verify OTP: Enter the OTP received on your mobile number to verify your identity.

- Provide Personal Details: Fill in your personal details, such as name, date of birth, and gender.

- Generate ABHA Card: After submitting the details, your ABHA card will be generated. You can download and print the card for future use.

Documents Required for ABHA Card Application

To apply for an ABHA card, you need the following documents:

- Aadhaar Card: Your Aadhaar number is required for identity verification.

- Mobile Number: A mobile number linked to your Aadhaar for OTP verification.

- Personal Details: Basic personal information such as name, date of birth, and gender.

Importance of Health Insurance for Senior Citizens

While the ABHA card provides access to digital health records and streamlines healthcare services, it is crucial to have comprehensive health insurance, especially for senior citizens. Health insurance for senior citizens ensures that older adults receive adequate medical care without financial strain.

Benefits of Health Insurance for Senior Citizens

- Coverage for Age-Related Ailments: Senior citizen health insurance plans cover various age-related ailments, including chronic diseases, which are common in older adults.

- Cashless Hospitalization: Many plans offer cashless hospitalization, where the insurer directly settles the medical bills with the hospital, reducing the financial burden on the insured.

- Pre and Post-Hospitalization Expenses: These plans often cover pre and post-hospitalization expenses, ensuring comprehensive care before and after hospital stays.

- Critical Illness Coverage: Some plans include coverage for critical illnesses like cancer, heart diseases, and kidney failure, providing financial support during severe health crises.

- No Claim Bonus: Senior citizen health insurance plans may offer a no-claim bonus, which rewards policyholders with additional coverage for every claim-free year.

Conclusion

The ABHA card is a significant step towards creating a more efficient and accessible healthcare system in India. By providing a unique health ID and digital health records, the ABHA card enhances the coordination and quality of healthcare services. Applying for an ABHA card is a simple process requiring minimal documentation. Additionally, securing health insurance for senior citizens is essential to ensure they receive comprehensive medical care without financial hardship. Together, the ABHA card and robust health insurance plans can significantly improve the health and well-being of individuals, particularly the elderly, in India.