In today’s digital age, online currencies, particularly cryptocurrencies, have emerged as an exciting and disruptive force in the financial world. As more people explore the potential of these digital assets, concerns about their regulation and safety have grown. This article aims to shed light on the topic of regulating online currencies, focusing on cryptocurrencies like Bitcoin and Ethereum. While some may see cryptocurrencies as a path to financial freedom, others worry about potential risks and the need for proper oversight to prevent abuse. Step into the world of profitable trading by visiting bitcointrader2.

The Rise of Cryptocurrencies

Cryptocurrencies have experienced a meteoric rise since the introduction of Bitcoin in 2009. These digital assets utilize blockchain technology, a decentralized and immutable ledger, to enable secure transactions without the need for intermediaries like banks. This revolutionary concept has attracted millions of users worldwide, leading to the development of thousands of different cryptocurrencies and numerous online trading platforms.

The Appeal of Decentralization

One of the primary appeals of cryptocurrencies is their decentralization. Traditional fiat currencies are controlled by governments and central banks, subject to economic policies and inflation. In contrast, cryptocurrencies operate independently of any central authority, which some proponents see as a safeguard against economic instability and government interference. Decentralization offers users a sense of financial empowerment, allowing them to have complete control over their assets without relying on traditional financial institutions.

Understanding the Risks

While the decentralized nature of cryptocurrencies offers advantages, it also comes with inherent risks. Without centralized oversight, fraudulent activities, money laundering, and tax evasion can become serious issues. The lack of regulation has made some skeptics wary of cryptocurrencies and online trading platforms, concerned that they may become a breeding ground for illegal activities due to the anonymity they provide.

Also See: How Vaginal Mesh Lawsuits Are Shaping the Future of the Medical Device Industry

Government Responses and Regulations

In response to the rapid growth of cryptocurrencies, governments worldwide have started developing regulatory frameworks to address potential risks and protect consumers. Some countries have embraced cryptocurrencies, recognizing their potential to foster innovation and boost economic growth. They have implemented clear guidelines to facilitate legitimate cryptocurrency use, providing investors with a sense of security.

The Challenge of International Regulation

One of the significant challenges in regulating online currencies is their borderless nature. The internet allows users to access online trading platforms from anywhere in the world, making it challenging for individual countries to implement consistent regulations. The lack of international coordination on cryptocurrency regulation can create regulatory arbitrage, where companies and individuals may exploit loopholes between jurisdictions.

Also see: Stablecoin Strategies: Exploring the World of Swapping and Staking TerraUSD (UST)

Protecting Investors and Consumers

As cryptocurrencies become more mainstream, the protection of investors and consumers has become a top priority for regulatory authorities. Market manipulation, fraudulent schemes, and cyberattacks have led to financial losses for many individuals. Regulators aim to establish measures that encourage innovation while safeguarding the public from potential pitfalls associated with these digital assets.

KYC and AML Compliance

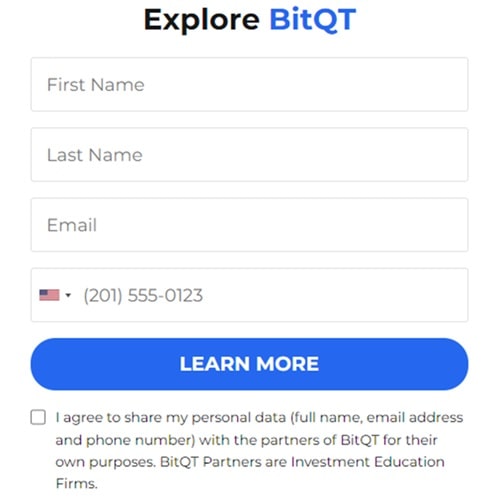

To counter illicit activities and enhance consumer protection, many online trading platforms adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. KYC procedures require users to verify their identities by providing identification documents, reducing the risk of anonymity that could enable criminal behavior. AML regulations focus on detecting and preventing money laundering activities, which can be facilitated by the use of cryptocurrencies due to their pseudonymous nature.

Balancing Innovation and Regulation

Finding the right balance between fostering innovation and imposing regulation is crucial for the future of online currencies. Overly restrictive measures might stifle technological advancements, hindering the potential benefits that cryptocurrencies and blockchain technology can bring to various industries. Striking the right balance will allow for responsible growth and create an environment where legitimate projects and businesses can thrive while mitigating risks.

Conclusion

As online currencies, particularly cryptocurrencies, continue to reshape the financial landscape, the need for appropriate regulation becomes increasingly evident. Striking a balance between innovation and protection is essential to ensuring the sustainable growth of this emerging sector. While there are challenges in implementing consistent international regulations, it is essential for governments and regulatory bodies to collaborate in creating a safe and secure environment for investors and consumers alike. Online trading platforms must also play their part by adhering to KYC and AML regulations to foster trust and credibility among their users. As the world navigates the future of finance, a responsible and well-regulated approach to online currency can pave the way for a more inclusive and technologically advanced financial system.

Also See

- Buying Bitcoin in Europe: Step-by-Step Instructions

- The Pros and Cons of Mining Crypto

- The Pros and Cons of Using Binance

- The Regulation of Online Currency: What You Need to Know