GST Council Considers Slashing Insurance Tax to 5%: Relief in Sight for Policyholders

In a move poised to make health and life insurance more affordable for millions of Indians, the Goods and Services Tax (GST) Council is set to deliberate on reducing the GST rate on insurance premiums from the current 18% to 5%. This proposal, aimed at…

Union Budget 2025: PHDCCI’s Call to Abolish Securities Transaction Tax

As the Union Budget 2025 approaches, industry bodies are actively presenting their demands to the Finance Ministry. Among the prominent voices, the PHD Chamber of Commerce and Industry (PHDCCI) has urged Finance Minister Nirmala Sitharaman to remove the…

CBDT Extends Deadline for Filing Belated and Revised ITRs

The Central Board of Direct Taxes (CBDT) has extended the deadline for filing belated and revised Income Tax Returns (ITRs) for the Assessment Year (AY) 2024-25. Taxpayers now have until January 15, 2025, to comply with their tax obligations, a relief…

Can You Really Go to Jail for Not Paying or Filing Taxes?

Did you know that the richest 10% of people, who earn $169,800 or more, pay nearly 75% of all taxes in the country? Most Americans believe that middle-class people pay the most taxes but the wealthiest 1% have the largest tax rate at 25.9%. Taxes are…

GST Tax: Advantages and Disadvantages

The Indian government implemented GST in the year 2017, and this new tax brought up a lot of changes in the overall tax collection regime. Before GST, there were other taxes applicable such as VAT, Excise, Service Tax, and others. But now, all the other…

Tax Deduction at Source (TDS) Advantages and Disadvantages

TDS stands for tax deduction at source. Tax Deduction at Source means that a certain portion of your tax will be deducted at the source of income itself. An example of this could be when you are receiving rent. If the rent is more than a certain amount,…

Impact of GST on Real Estate Sector in India

One of the biggest industries in India is the real estate industry. It contributes between 6% and 8% to the country’s GDP. In addition, the real estate industry is right after the IT industry when it comes to the Indian GDP. Before GST, there were…

How FICA Payroll Taxes Impact Your Take-Home Pay

From an employee’s perspective, payroll taxes can be confusing. Ensuring employers accurately file these employment taxes is critical to avoid penalties and back tax payments. FICA (Federal Insurance Contributions Act) taxes are the familiar…

Income Tax Return (ITR) Filing Advantages and Disadvantages

If your net income exceeds the 2.5 lakh rupee limit, then you automatically become eligible for an income tax return. However, the income tax percentage depends upon the net income of an individual, corporate entity, authority, or group of individuals.…

Impact of GST on the Automobile Sector in India

The automobile sector is huge in India and comes with many operational challenges. Low-profit margins, high fixed costs, and ever-changing emission norms pose new challenges for India’s automobile sector. Even the people in India seek…

Impact of GST on the Construction Industry in India

Since India is a developing economy, the construction industry in India is huge. Because of the availability of disposable cash, many people are building their homes, and there is also a surge in sky scrapper. With the implementation of GST, everyone was…

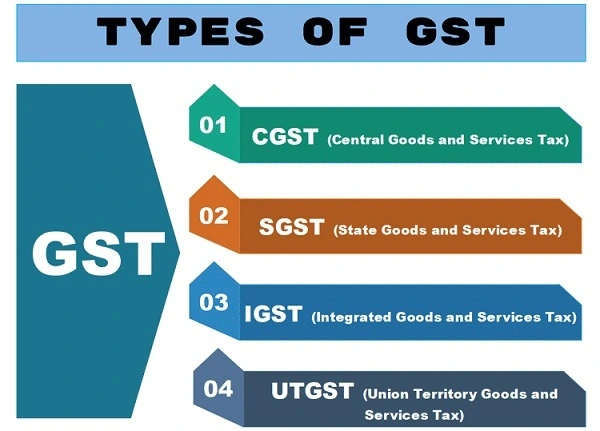

Types of GST – SGST, CGST, IGST and UGST Explained

The government earns revenue with two taxes. These are direct taxes and indirect taxes. An example of direct taxation is income tax, and an example of indirect tax is GST. GST stands for Goods and Service Tax. This is a value-added tax that replaced all…

Impact of GST on Consumers in India

Until 2017, the indirect tax structure in India was quite complicated. It was simplified with the introduction of GST in the country. GST not only combined all the taxes but also helped eliminate the cascading effect of tax and double taxation. The tax…

Impact of GST on Textile Industry in India

The textile industry is one of the most basic industries in any economy. Food, shelter and clothing come at the bottom of Maslow’s Hierarchy of Needs. By this itself, you would have understood the importance of the textile sector. The textile…

Impact of GST on State Revenue of India

GST was a significant change for the Indian economy and faced a fair amount of resistance. There have certainly been many benefits of GST, but just like two sides of the coin, there were also some negatives of the GST implementation. Under the GST, the…

Impact of GST on Banking Sector in India

The banking sector is the backbone of any economy, and any impact on the banking sector affects the whole economy. Even the banking sector was scoped within the framework when the GST was implemented. The GST impacted banking and the customer as the bank…

Income Tax Planning in India: What Do You Need to Know

Income tax planning is an essential aspect of financial management. It is important to have a solid understanding of the various tax laws and regulations that impact you and businesses alike. Effective income tax planning can help minimise your tax…

Impact of GST on the Logistics Industry in India

The logistics sector in any country joins the manufacturers & producers with the trading activity. It is the core of any economy, and the sector is heavily involved in the development of the country. The logistics industry always tries to improve…

Impact of GST on Media and Entertainment in India

In India, the Mediate and Entertainment industry is huge. The penetration of media and entertainment has increased because of the factors like OTT, cheap subscriptions and affordable Internet. In addition, smartphones have made it possible for the…

Impact of GST on Computers in India

Everyone needs a computer to work on. It doesn’t matter if you are an employee, student, business owner or commoner. You need to have a computer to do your work. It is not optional in the era that we live in. Talking about computers, you will also…

Impact of GST on Business in India

GST was implemented on 1 July 2017 in India and marketed as a revolutionary taxation system that will make things easy for everyone. It combined various taxes into a single tax, making it easy to understand from the customer’s point of view. GST…

Impact of GST on FMCG Distributors & Products in India

India’s FMCG industry is one of the largest in the world. The main reason for that is the population. Today, brands also have their reach in rural areas, and the credit goes to the strong distribution network along with the population. FMCG, also…

Impact of GST on Import and Export of India

Before 2014, the import bills of India were huge, and the government wanted to take action to reduce the import bills. This was when they came up with the Make in India policy. The government incentivized local manufacturing, and over the years, India…

Impact of GST on the Retail Sector in India

The tax structure in India was complicated, a challenge that many businesses in India faced. Under the NDA government, a new reform was brought to the tax structure. These reforms were in the form of introducing the Goods and Services Tax, also known as…

Tax Planning Advantages and Disadvantages

When you are earning, you are subjected to income tax. The tax rates are significantly higher for high-income individuals. You don’t pay taxes on the full pay, but you calculate the taxable income to calculate the tax. The taxable income is arrived…

The Impact of GST on The Used Car Market in India

India is the largest democracy thriving in every type of business. India is also a country that is about to cross China in population. So, it would not be wrong to say that people here have demands for a certain lifestyle. The automobile market has been…

Value Added Tax (VAT) Advantages and Disadvantages

Value Added Tax, also known as VAT, is imposed on a product or a service at every step in the supply chain. The logic is simple, stating that if the product’s value is enhanced, then the value-added tax should be added. The tax is calculated on the…

Direct Tax Advantages and Disadvantages

As a citizen of any country, you pay different types of taxes. These taxes can be classified into direct tax and indirect tax. Paying these taxes is not discretionary, and the calculations are based on the slabs given by the government. Today, we are…