These days, both budding entrepreneurs and well-established businesses are constantly on the hunt for methods to streamline their operations, boost their credibility, and rake in more profits. One tactic that’s been a consistent hit is company incorporation. Incorporation is all about creating a separate legal entity that safeguards its owners and shareholders from personal liability while providing a boatload of financial and legal perks. But, as you might’ve guessed, this sought-after business structure isn’t all sunshine and rainbows, it has its fair share of drawbacks too.

To figure out if this move is right for your company, it’s essential to grasp the delicate balance between the pros and cons. In this all-inclusive article, we’ll dive headfirst into the complex world of incorporation, dissecting its upsides and downsides to help you make a well-informed decision. So, without further ado, let’s get down to it then!

Advantages Of Incorporation Of A Company

Incorporating your business/company comes with a whole bunch of perks that make it a top choice among entrepreneurs. So, let’s dive in and check out these fantastic advantages of turning your business into a corporation, shall we?

1. Limited Liability Protection

One of the most significant advantages of incorporating your business is that it offers limited liability protection to its owners. When a business gets incorporated, it turns into a separate legal entity from the owners, which means the business itself is responsible for its debts and liabilities. What does that mean for you? Well, your personal assets, like your house or your savings, are safe from being snatched away to cover your business’s debts or liabilities. This protection is super important, especially if you’re in an industry where lawsuits or other legal troubles are lurking around the corner.

2. Tax Benefits

Do you know what’s awesome about incorporating your company? The tasty tax benefits that come with it! Depending on the tax laws in your country, corporations might be eligible for deductions that other business types can’t even dream of. Plus, corporate tax rates could be lower than those for other businesses, which means less tax burden for you. This leads to some pretty cool savings on business taxes, giving you more cash to put back into your business.

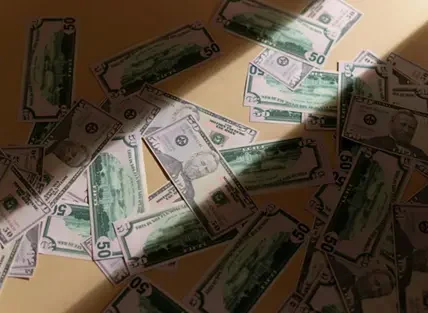

3. Access to Capital

Incorporating a business can also help you attract some much-needed dough, and we all know that capital is key for growth and expansion. And you may be wondering how it actually works. By issuing shares of stock, corporations can reel in investors who are eager to put their money into your business and get a slice of the ownership pie. This can bring in a sweet chunk of change that you can use to kickstart new projects, expand your operations, or add more talent to your team. Plus, corporations often have a reputation for being more stable and trustworthy than other business types, making it a breeze to secure loans or other financing options.

4. Boost Your Credibility and Professional Image

Last but not least, incorporating your business can amp up its credibility and professional image. A lot of customers, investors, and vendors see corporations as more established and trustworthy compared to other types of businesses. This can lead to increased sales, more investment opportunities, and better deals with vendors. On top of that, incorporating helps protect your company name and brand, giving you a solid foundation for long-term success.

Disadvantages Of Incorporation Of A Company

While the incorporation of a company comes with its perks, it’s crucial to be aware of the potential downsides as well. In this section, let’s explore the disadvantages of incorporating, such as complexities and expenses, legal red tape, diminished control, and double taxation.

1. Navigating the Maze and Expenses

Diving headfirst into incorporation can feel like navigating a confusing labyrinth, not to mention it can be quite a costly affair. You’ll have to deal with a whole bunch of paperwork and legal documents to get your corporation up and running. This can take up a good chunk of time, and you might even need to call in the big players, legal and financial experts, to make sure you’re meeting all the legal must-dos. But wait, there’s more! Keeping your corporation sailing smoothly can also put a dent in your wallet. You’ve got to stay on top of a bunch of rules and demands, like submitting annual reports, keeping your records squeaky clean, and putting together regular meetings for the board of directors, and shareholders. All these necessities can rack up extra costs, like legal and accounting fees. So, be prepared!

2. Formalities and Regulations

Corporations have to navigate a sea of formalities and regulations. This includes corporate governance, financial reporting, and tax compliance requirements. For instance, corporations must hold an annual board of directors and shareholder meetings, and document minutes from these gatherings. Plus, they need to keep detailed financial transaction records and submit regular reports to state or federal authorities. Failing to abide by these regulations can result in penalties and legal action.

3. Diminished Control

Incorporating might mean giving up some control for the business owner. Once a business is incorporated, it morphs into a separate legal entity, and control is divided among the board of directors and shareholders. This means the original business owner may not have as much say over the company’s decisions and operations. The board of directors could make decisions that don’t align with the owner’s vision. Moreover, shareholders may possess voting rights that allow them to sway the company’s direction.

Conclusion

All in all, it is hard to deny that incorporating your company or business comes with a boatload of perks, like limited liability protection, tax advantages, access to funding, and a boosted professional reputation. But don’t be fooled, it’s not a magic bullet for everyone, you’ll also face complexities, expenses, more regulations, reduced control for business owners, and the headache of double taxation. So, if you’re an entrepreneur or business owner, it’s essential to carefully size up the pros and cons of incorporating your biz to see if it fits your long-term objectives and vision. Only then should you take the leap and incorporate, otherwise, it’s just like throwing a dart into the unknown.